Forex, arguably, is the most widely discussed financial market today. There are several reasons why everybody is talking about Forex. One of the factors that have contributed towards Forex’s popularity is the fact that it remains operational round the clock. Visit multibank group

The Forex market keeps its doors open to international participants throughout the day and that’s one of its biggest strengths. While the Forex market never remains shut and offers traders a wide range of opportunities, you have to be mindful of the time frames you choose to trade in. You must study the important Forex trading hours carefully before you begin your journey as a trader.

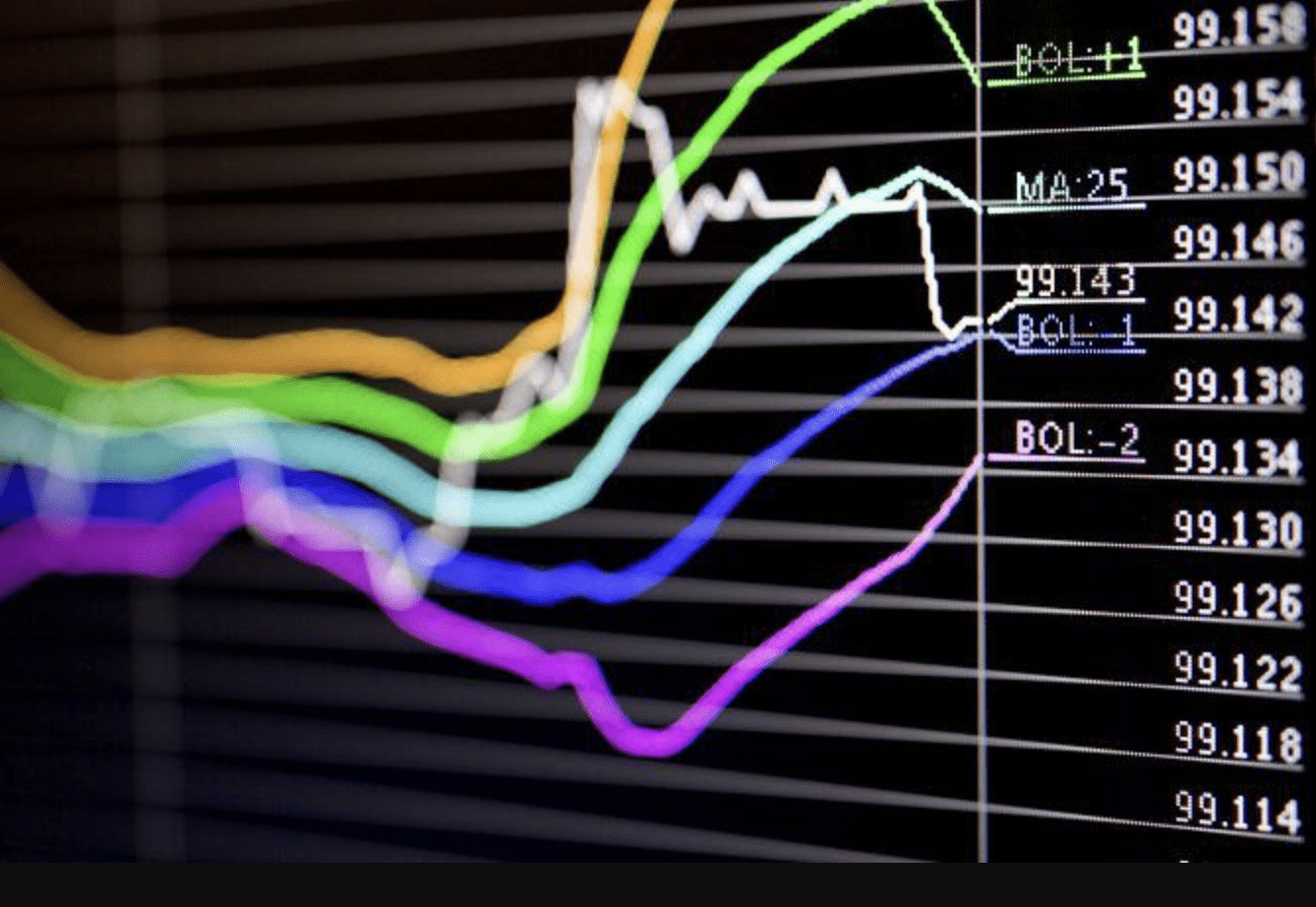

Forex Market Hours

The foreign exchange market comprises big organizations, hedge funds, asset management companies, investors and retail brokers. The market hours provide traders with a timetable which helps them get a fair idea about the timings or hours during which they should carry out currency operations.

Full-fledged trading sessions can be conducted during certain business hours. In this sense, the trading hours for the forex market are designed in a manner similar to the conventional stock exchange hours.

Since there are multiple markets across the world, one can enter Forex at any given point in time. When a particular session comes to an end, you can quickly move on to the next one. The Forex market remains closed only during holidays or weekend breaks.

When it comes to Forex trading, you have to be attentive toward multiple markets. A large number of markets are accommodated by this network. Trading hours are driven by the time at which trading operations start in different time zones.

Importance of Forex Market Hours

You can trade currency pairs as and when you wish to. However, it is important to remember that no investor or trader can possibly monitor the market all the time. One cannot keep an eye on a position for several hours at a stretch. Also, the kind of opportunity a market hour offers could widely differ from the nature of the opportunity another market hour provides you with.

As a trader maneuver through the day, they will come to the realization that different currency pairs exhibit different activities or trends. Market participants come from a wide range of demographic hours and therefore, carry out their engagements at different hours of the day. Traders get the opportunity to maximize their profits during busy or highly active market hours.

When you are about to participate in a session as a Forex trader, you should know what to expect from it. If you are not sure about your expectations, you could miss out on an opportunity to make a profit.

There are times when a trader is far away from their computer or some other device when the market turns volatile. This also results in them losing out on a lucrative opportunity to make a profit.

What a Trader Should Focus On

While your aim should be to make profits, you must work towards minimizing the possible risks during this process. Once you become aware of the commonly occurring volatility patterns, you can choose the right window for you to trade.

With time, every trader develops their own individualistic style. This style or the methods adopted by them drive them towards becoming a successful trader. You must, therefore, keep your personal preferences in mind while selecting the trading hours or window. If you trade during the hours you are most comfortable in, you will have a higher chance of making a profit.

When you trade, one of the first things you need to determine is whether high-volatility trading hours will complement the techniques or methods you use. A trading hour that works well for a trader might not prove to be beneficial to you.

You should make an effort towards identifying the trade times that prove to be suitable for you. For some traders, a particular session turns out to be hugely profitable and at times, they benefit from the overlap that takes place between different exchanges. An economic situation or a political move, too, could help a trader at a given point in time.

Startup Capital

While you should look at ways to maximize your profits by trading at the right time, you must also do a few things to safeguard your investment. Many a time, Forex traders start trading with the objective of making easy money or getting themselves out of a difficult debt situation.

When you take your first steps into the world of Forex trading, you will come across several Forex marketers who will implore you to invest a large amount of money as capital. However, it would be advisable not to take a huge risk when you have just started trading. Even when you invest a small amount, you could get a high return on it.

Managing Risks

To have a long run as a trader, you have to be adequate at managing risks. Those who master the art of risk management not only make profits at regular intervals but also manage to build a very good profile for themselves as traders. Before making profits, you must focus on protecting your initial investment and ensuring that you do not lose out on it.

There are different ways in which you can manage the various risks associated with trading. When your capital starts depleting, you should know that your chances of making a profit, too, are getting lesser. If you are not confident about a particular trade, you should stay away from it.

Your trading results are driven by a bunch of important factors. While it is important to have a basic knowledge of trading sessions, you should also make it a point to speak to experienced traders and get some guidance from them in this direction.

Sometimes, a forex trader wakes up early in the morning and keeps monitoring everything till it is midnight. While chasing the right trading hours to make a profit, you mustn’t forget an important thing. Your health and well-being come first and there should be no compromises made on that front.